Helping Your Children With Good Money Habits

GUEST BLOGGER: MARK WASHINGTON, CADENCE BANK CRA MANAGER

Foreward by Debbie Nazarian, Lemonade Day National Director

“All Lissa dreamed of was a turtle to add to her pet collection. When her daddy put his foot down against having another animal in the house, Lissa decided to use a lemonade stand as a means of getting that turtle.” – an excerpt from It All Started With a Turtle

Lisa Holthouse, Lemonade Day co-founder of Lemonade Day with her husband Michael, authored this book about the birth of Lemonade Day. Neither she nor Michael knew at the time that their daughter Lissa’s desire for a turtle would be the beginning of a worldwide organization that teaches kids how to start and run a business.

As parents, grandparents, and aunts and uncles, we’ve all heard this same question from the children in our lives: “Can I have XYZ? Pleeezzzeeee!” Sometimes the request is for a piece of candy and other times, the item can be more expensive – a bike, a phone, even a pet. How we handle those conversations are tied to educating kids about the value of money and ultimately, their ability to make smart financial decisions in the future.

I remember having a savings account as a kid and was excited to deposit money I earned from chores and babysitting jobs. I loved going with my dad to the bank and making my deposits. It made me proud to see my savings balance grow, and when I was older, I had enough for a down payment on my first car…a Ford Pinto.

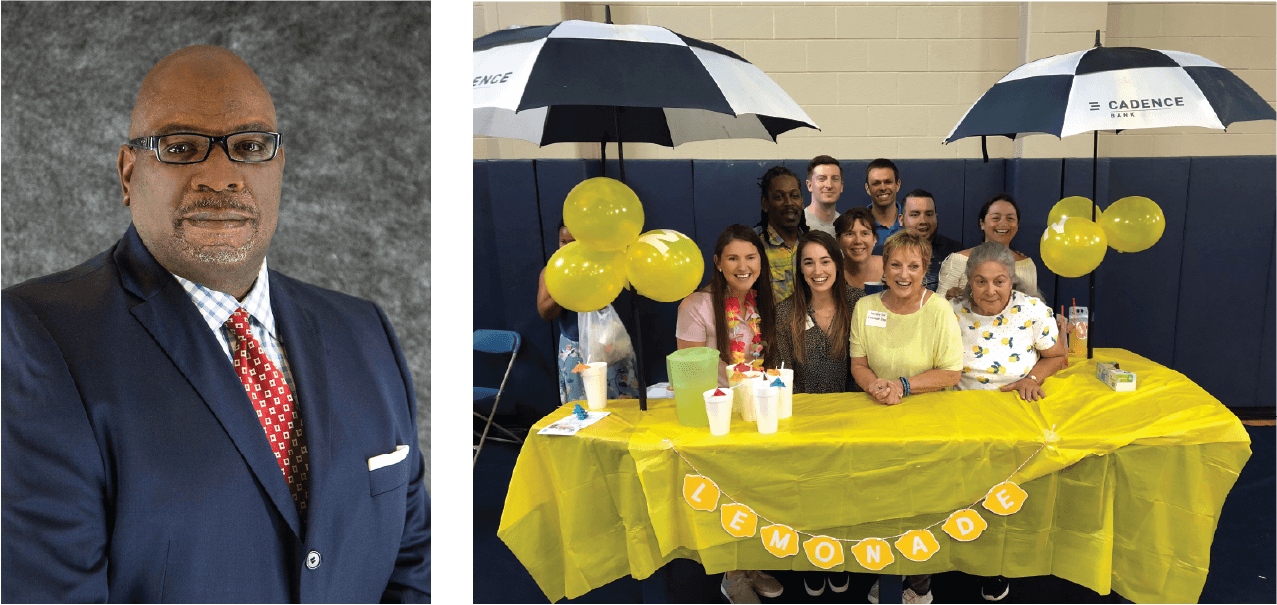

As we continue to explore financial literacy during the month of April, I asked Mark Washington from our wonderful partner, Cadence Bank, to weigh in on the benefits of teaching financial skills to kids. Cadence Bank employees have made a tremendous impact on the students they have mentored for Lemonade Day through several of their 98 branches in cities throughout the south. We are so grateful for our partnership with Cadence Bank and look forward to working with them for many more years to come!

Mark graciously shared his insights on why it’s important to develop habits of planning, earning, saving, borrowing and buying at an early age to support goals and priorities. I love some of the interactions he talks about with our Lemonade Day kids! We can all learn much from these kidpreneurs.

Why did Cadence Bank get involved with Lemonade Day?

Mark: “The organization is well-aligned with our mission and goals, supporting businesses and being a good corporate steward. Lemonade Day is a great way for our associates to complete required service hours – and do the right thing – by teaching business and financial skills to participating aspiring entrepreneurs. As bankers, we know how important it is to start early with financial education to set children up for success. Lemonade Day offers a hands-on way for kids to immerse themselves in the business world. Along the way, they learn sound financial concepts, analytical skills and decision making without even realizing they’re learning! I can’t think of a better way to invest in tomorrow’s business leaders and in the future of our communities. The partnership with Lemonade Day has been a great partnership for us that has grown over the years.”

Should kids be encouraged to open a savings account and why?

Mark: “Yes! Having a savings account is the first step in teaching children about the importance of good money habits. Children are often rewarded with money for doing good deeds such as maintaining good grades in school, doing chores or performing neighborhood services such as cutting grass or washing cars. And most children know about its buying power. A savings account teaches other important financial lessons, like introducing savings habits, compounding interest and building wealth. It’s also a great way to introduce them to the world of banking.”

How much should kids save?

Mark: “I don’t think there is a set amount as to how much a kid should save. Early on, it’s more about learning the value of money and the importance of putting some away instead of spending everything they have.”

What has to happen for the kids who are under 18 to be more financially literate than the generations (Millennials, Gen X, Y, and Z) before them?

Mark: “It’s really simple: they need solid financial education, and parents and guardians to provide good examples of money management.”

If a child approached the Bank looking for an investor/loan, what are the top three tips you would give that budding entrepreneur to pitch his/her business (lemonade stand or another business idea.)

Mark: “Well, you have to be at least 18 years of age to apply for a loan and sign a financial agreement, but you’re never too young to learn business skills. The foundation of any successful business pitch is a sound business plan. It’s also important to really know your market and to develop a relationship with your banker and financial institution.”

What is the most impactful situation you've witnessed, positive or negative, with kids and saving money OR during Lemonade Day?

Mark: “I often tell this story when speaking about my Lemonade Day experiences. A couple of years ago during the bank’s Lemonade Day mentoring activities, I was speaking to my kindergarten class about marketing. At first, I didn’t think the kids would grasp the idea of marketing their lemonade to consumers since they were so young. I was trying to bring the concept down to their level when one of the kids raised his hand and asked me if it would be possible to sell additional items that would make the consumer thirsty, like pretzels, peanuts or potato chips. I was shocked at the suggestion because I knew I would never have thought of that when I was his age. I said, “YES, of course, YES!!!” It just proves that kids have amazing minds and are capable of understanding more than we sometimes give them credit for.”

What's the most interesting thing a business owner could learn from a Lemonade Day stand business owner?

Mark: “I’m always amazed at how creative the kids are. Two areas where these young entrepreneurs really excel are product presentation and good customer service.”

What's the long-term effect of a lack of financial literacy on our worldwide economy?

Mark: “On an individual level, financial literacy is the ability to understand how to make sound financial choices so you can confidently manage and grow your money. This includes basics, such as understanding how to set a budget, how to manage debt, the importance of creating an emergency fund and developing a plan for retirement. A lack of financial literacy leads to poor financial decision making, which leads to an increasing likelihood of poverty. Foreclosure, bad credit scores, high debt and lack of preparation for the future are all a drain on the economy.”

Why do you think Lemonade Day youth entrepreneurs are positioned to succeed?

Mark: “They often have the opportunity to learn from financial subject matter experts who take the time to teach entrepreneurship and the basics of owning a business. These mentors provide real life examples at age-appropriate levels the young entrepreneurs can relate to and understand. It’s a great role-playing exercise that shows these young people the many different paths to success and the pitfalls that can lead to potential failure in owning a business.”

As you look back at the Lemonade Day journey and your company's involvement with the organization, what do you believe is the organization's greatest accomplishment?

Mark: “Our greatest accomplishment is planting the seed of entrepreneurship in a child’s mind, letting them know that they aren’t limited to being consumers. They can have the security of being their own boss, creating wealth and providing for their future families.”

Thank you, Mark, not only for this blog but for all you and Cadence Bank’s associates do for Lemonade Day. We appreciate you so very much!

After a few attempts at a lemonade stand and learning the financial lessons of owning a business from her dad, Lissa did buy a turtle – a crystal paperweight. Every Lemonade Day season, the Holthouses take out the crystal turtle and reminisce on how it all began!

Registrations are now open at Lemonade Day cities across North America. Visit https://www.lemonadeday.org/find-your-city for more information.

Thanks for reading and please feel free to share this blog with others and share my contact information, debbie@lemonadeday.org with anyone who would like to know how to help us provide our program to more children and youth or start Lemonade Day in a new city!

I welcome your comments, questions and suggestions. For more information about Lemonade Day, please visit www.lemonadeday.org.

back to blog

GUEST BLOGGER: MARK WASHINGTON, CADENCE BANK CRA MANAGER

Foreward by Debbie Nazarian, Lemonade Day National Director

“All Lissa dreamed of was a turtle to add to her pet collection. When her daddy put his foot down against having another animal in the house, Lissa decided to use a lemonade stand as a means of getting that turtle.” – an excerpt from It All Started With a Turtle

Lisa Holthouse, Lemonade Day co-founder of Lemonade Day with her husband Michael, authored this book about the birth of Lemonade Day. Neither she nor Michael knew at the time that their daughter Lissa’s desire for a turtle would be the beginning of a worldwide organization that teaches kids how to start and run a business.

As parents, grandparents, and aunts and uncles, we’ve all heard this same question from the children in our lives: “Can I have XYZ? Pleeezzzeeee!” Sometimes the request is for a piece of candy and other times, the item can be more expensive – a bike, a phone, even a pet. How we handle those conversations are tied to educating kids about the value of money and ultimately, their ability to make smart financial decisions in the future.

I remember having a savings account as a kid and was excited to deposit money I earned from chores and babysitting jobs. I loved going with my dad to the bank and making my deposits. It made me proud to see my savings balance grow, and when I was older, I had enough for a down payment on my first car…a Ford Pinto.

As we continue to explore financial literacy during the month of April, I asked Mark Washington from our wonderful partner, Cadence Bank, to weigh in on the benefits of teaching financial skills to kids. Cadence Bank employees have made a tremendous impact on the students they have mentored for Lemonade Day through several of their 98 branches in cities throughout the south. We are so grateful for our partnership with Cadence Bank and look forward to working with them for many more years to come!

Mark graciously shared his insights on why it’s important to develop habits of planning, earning, saving, borrowing and buying at an early age to support goals and priorities. I love some of the interactions he talks about with our Lemonade Day kids! We can all learn much from these kidpreneurs.

Why did Cadence Bank get involved with Lemonade Day?

Mark: “The organization is well-aligned with our mission and goals, supporting businesses and being a good corporate steward. Lemonade Day is a great way for our associates to complete required service hours – and do the right thing – by teaching business and financial skills to participating aspiring entrepreneurs. As bankers, we know how important it is to start early with financial education to set children up for success. Lemonade Day offers a hands-on way for kids to immerse themselves in the business world. Along the way, they learn sound financial concepts, analytical skills and decision making without even realizing they’re learning! I can’t think of a better way to invest in tomorrow’s business leaders and in the future of our communities. The partnership with Lemonade Day has been a great partnership for us that has grown over the years.”

Should kids be encouraged to open a savings account and why?

Mark: “Yes! Having a savings account is the first step in teaching children about the importance of good money habits. Children are often rewarded with money for doing good deeds such as maintaining good grades in school, doing chores or performing neighborhood services such as cutting grass or washing cars. And most children know about its buying power. A savings account teaches other important financial lessons, like introducing savings habits, compounding interest and building wealth. It’s also a great way to introduce them to the world of banking.”

How much should kids save?

Mark: “I don’t think there is a set amount as to how much a kid should save. Early on, it’s more about learning the value of money and the importance of putting some away instead of spending everything they have.”

What has to happen for the kids who are under 18 to be more financially literate than the generations (Millennials, Gen X, Y, and Z) before them?

Mark: “It’s really simple: they need solid financial education, and parents and guardians to provide good examples of money management.”

If a child approached the Bank looking for an investor/loan, what are the top three tips you would give that budding entrepreneur to pitch his/her business (lemonade stand or another business idea.)

Mark: “Well, you have to be at least 18 years of age to apply for a loan and sign a financial agreement, but you’re never too young to learn business skills. The foundation of any successful business pitch is a sound business plan. It’s also important to really know your market and to develop a relationship with your banker and financial institution.”

What is the most impactful situation you've witnessed, positive or negative, with kids and saving money OR during Lemonade Day?

Mark: “I often tell this story when speaking about my Lemonade Day experiences. A couple of years ago during the bank’s Lemonade Day mentoring activities, I was speaking to my kindergarten class about marketing. At first, I didn’t think the kids would grasp the idea of marketing their lemonade to consumers since they were so young. I was trying to bring the concept down to their level when one of the kids raised his hand and asked me if it would be possible to sell additional items that would make the consumer thirsty, like pretzels, peanuts or potato chips. I was shocked at the suggestion because I knew I would never have thought of that when I was his age. I said, “YES, of course, YES!!!” It just proves that kids have amazing minds and are capable of understanding more than we sometimes give them credit for.”

What's the most interesting thing a business owner could learn from a Lemonade Day stand business owner?

Mark: “I’m always amazed at how creative the kids are. Two areas where these young entrepreneurs really excel are product presentation and good customer service.”

What's the long-term effect of a lack of financial literacy on our worldwide economy?

Mark: “On an individual level, financial literacy is the ability to understand how to make sound financial choices so you can confidently manage and grow your money. This includes basics, such as understanding how to set a budget, how to manage debt, the importance of creating an emergency fund and developing a plan for retirement. A lack of financial literacy leads to poor financial decision making, which leads to an increasing likelihood of poverty. Foreclosure, bad credit scores, high debt and lack of preparation for the future are all a drain on the economy.”

Why do you think Lemonade Day youth entrepreneurs are positioned to succeed?

Mark: “They often have the opportunity to learn from financial subject matter experts who take the time to teach entrepreneurship and the basics of owning a business. These mentors provide real life examples at age-appropriate levels the young entrepreneurs can relate to and understand. It’s a great role-playing exercise that shows these young people the many different paths to success and the pitfalls that can lead to potential failure in owning a business.”

As you look back at the Lemonade Day journey and your company's involvement with the organization, what do you believe is the organization's greatest accomplishment?

Mark: “Our greatest accomplishment is planting the seed of entrepreneurship in a child’s mind, letting them know that they aren’t limited to being consumers. They can have the security of being their own boss, creating wealth and providing for their future families.”

Thank you, Mark, not only for this blog but for all you and Cadence Bank’s associates do for Lemonade Day. We appreciate you so very much!

After a few attempts at a lemonade stand and learning the financial lessons of owning a business from her dad, Lissa did buy a turtle – a crystal paperweight. Every Lemonade Day season, the Holthouses take out the crystal turtle and reminisce on how it all began!

Registrations are now open at Lemonade Day cities across North America. Visit https://www.lemonadeday.org/find-your-city for more information.

Thanks for reading and please feel free to share this blog with others and share my contact information, debbie@lemonadeday.org with anyone who would like to know how to help us provide our program to more children and youth or start Lemonade Day in a new city!

I welcome your comments, questions and suggestions. For more information about Lemonade Day, please visit www.lemonadeday.org.

@LemonadeDayNational